- Frontera by Bando

- Posts

- 🧠 The Ideas That Will Shape Crypto in 2026

🧠 The Ideas That Will Shape Crypto in 2026

What we think of Coinbase Ventures’ RFS

Real problems. Real solutions. Real data. This is Frontera.

Your weekly dose of data-driven crypto insights from the edges of the world. Trusted by leaders at Bitso, Binance, the Solana Foundation, the Ethereum Foundation, and more.

This is where you start if you’re building, investing, or scaling in frontier markets.

This Edition Is Brought To You By Bridge

Bridge makes it simple to receive, hold, issue, and use stablecoins. Unlock new markets, launch new products, and make money move. Discover how at bridge.xyz

🧠 The Ideas That Will Shape Crypto in 2026

Again, I'd like to start off giving a warm welcome to all the new Frontera subscribers joining us!

We're glad you're here, and thank you for attending our events

Frontera is where the intersection of frontier markets and crypto gets documented, decoded, and debated. Every week, we cover the most important trends, technologies, and builders shaping the financial future of the global majority.

If you’re new, here are some of my favorite essays to get started:

Now, on to the news.

Coinbase Ventures just laid out the themes they believe will shape 2026 in their newest Request for Startups, essentially answering the question thousands of founders ask themselves every year: what should I build next?

If you needed an idea, or thought about pivoting, this is the sign you were looking for.

Their note reflects how much the industry changed in 2025. Stablecoins became part of everyday payment flows, prediction markets found real mainstream traction, and new DEX designs pushed the idea of “markets for everything” from theory into practice.

Markets have more liquidity. Privacy tools are improving. Interoperability works. And AI is beginning to plug directly into onchain rails. Coinbase Ventures sees this as the setup for a fresh wave of ambitious teams and is pointing to the categories where they want to deploy capital.

Which are these four:

1. RWA Perpetuals

Coinbase Ventures sees a new class of synthetic markets emerging around real-world assets. Instead of waiting for full tokenization, teams can use perpetual futures to offer exposure to anything since they don't require underlying assets: private companies, macro indicators, commodities, even economic data.

Hell, even Labubus and Pokemon cards (see Trove Markets).

It’s the “perpification” of assets that have never traded onchain. Traders now want ways to hedge and express views beyond simply holding crypto, and the infrastructure can now support it.

We can see this live in Hyperliquid where you're now able to long stocks thanks to HIP-3 and Trade.xyz, and even private companies such as SpaceX through Ventuals.

I too expect to see more of this and of course I'll be longing them too.

2. Specialized Exchanges & Trading Terminals

Coinbase Ventures is betting on two trading ideas gaining real momentum: smarter exchange design and next-generation terminals for prediction markets. Prop-AMM models are giving liquidity providers real protection for the first time, and 2025 proved how much demand there is for exchanges built around healthier market structure.

On the other side, prediction markets are growing fast but still feel fragmented/complex/confusing/and many more adjectives (not to me). A unified terminal that aggregates odds, liquidity, and routing across venues is the obvious next step.

2026 will give birth to the prediction market trenches through these newer trading terminals. We all saw the rise of the Solana trenches, and the same will be true here.

As an active polymarket trader (not a gambler), an automated prediction-market arbitrage for “free money” through spreads would be a game-changer.

3. Next-Gen DeFi

DeFi is shifting toward products that feel closer to real financial infrastructure.

Perps + lending: Perp venues are linking with lending markets so traders can earn yield on collateral while keeping positions open.

Unsecured credit: New reputation and data models aim to unlock onchain lending without collateral, tapping into a massive credit market. This one can be huge for consumers.

Privacy rails: Private trading and payments are becoming mandatory as users and institutions refuse to expose their entire financial history onchain. Look at the Zcash explosion, the people yearn for privacy.

4. Ai and Robotics

AI is starting to collide with crypto in ways that open entirely new categories ripe for exploration:

Robotics data networks: Robots need better training data, and decentralized reward systems could help collect the physical-interaction datasets they’re missing.

Proof of humanity: As AI content becomes indistinguishable from real activity, cryptographic identity is turning into a core requirement for the internet.

AI agents for onchain development: Smart-contract creation and security checks are moving toward “Copilot-style” automation, making it possible for non-technical founders to launch onchain products in hours.

Two More Ideas That Matter

I’ll take the liberty of adding two themes I’m personally excited to see evolve in 2026.

Abstracted consumer apps: These are apps that hide all crypto complexity for the everyday user but run fully onchain, leveraging crypto’s strengths (speed, liquidity, programmability) to offer products far superior to anything normies use today. People will use them because they're better. We just have to build them.

Local stablecoins: Stablecoins denominated in local currencies, designed to settle payments, payroll, and domestic flows. If the $9T/day FX market is going onchain, and it will, because of the same three reasons mentioned on the theme above, then we need both sides of every pair.

And don’t worry, I'll be here covering everything.

🇧🇷 Brazil

After three years, Brazil’s Central Bank published its full crypto framework, formally integrating the industry into the financial system and requiring mandatory licenses for all Virtual Asset Service Providers.

Our friends at Minteo launched BRLM, a stablecoin pegged to Brazilian reais, live on Polygon, adding another BRL-backed stablecoin to the competition.

🇲🇽 Mexico

Bitso is launching an aggregated perps platform through Bitso Onchain with unified trading across multiple DEXs in early Q1, and a Bitso Onchain token planned for 2026.

🇪🇸 Spain

A new bill in Spain proposes to raise taxes on crypto gains, shifting them to the high-income bracket (up to 47%) instead of the current savings-rate cap, imposing stricter reporting and seizure rules.

🌎 Stablecoins

Klarna announced its stablecoin KlarnaUSD, becoming the first bank to launch on Tempo, the payments chain backed by Stripe and Paradigm, aiming to bring faster, cheaper cross-border payments to its 114M customers. This is part of what we've been writing about at Frontera, the race from Fintech 2.0 to Fintech 3.0 is on.

Circle unveiled StableFX, an onchain FX engine offering 24/7 RFQ pricing and instant settlement, plus a Partner Stablecoins program bringing multiple local stablecoins to Arc. What did I say about onchain FX and local stablecoins…

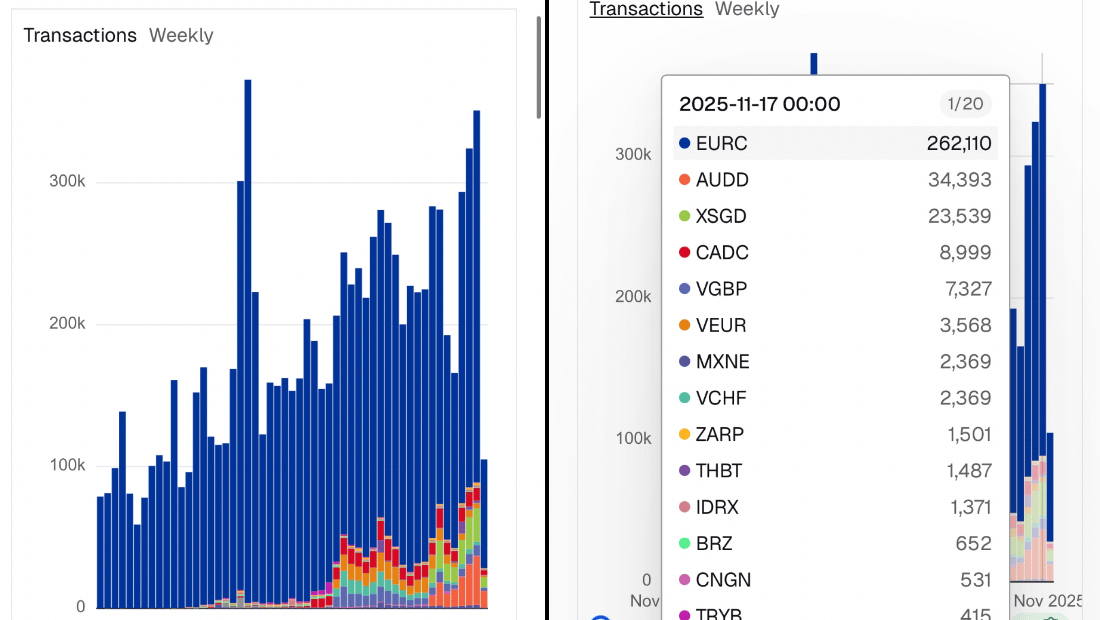

Local stablecoins on Base have climbed to over 300K weekly transactions, continuing a steady uptrend as Base’s Jesse Pollak publicly backs local rails again as part of the chain’s strategy.