- Frontera by Bando

- Posts

- 🐈⬛ Schrödinger’s All-Time High

🐈⬛ Schrödinger’s All-Time High

Bitcoin’s state of quantum superposition

Real problems. Real solutions. Real data. This is Frontera.

Your weekly dose of data-driven crypto insights from the Latin American frontier. Trusted by leaders at Bitso, Binance, the Solana Foundation, the Ethereum Foundation, and more.

This is where you start if you’re building, investing, or scaling in frontier markets.

Reading this by email? Click Read Online in the top right corner to view the full edition. Or listen to the full episode here.

And don't miss this week's guest podcast with Nathan Sexer from the Ethereum Foundation, to break down everything you need to know about Devconnect ARG 2025.

This Edition is Presented by Bitso’s Stablecoin Conference

Frontera is an official media partner of Bitso’s Stablecoin Conference 2025.

We’ll be on the ground in Mexico City this August 27–28, covering the builders, the breakthroughs, and ideas reshaping LatAm’s financial future.

Use the code FRONTERA10 for 10% off your ticket here.

🐈 Is the Cat Dead or Alive?

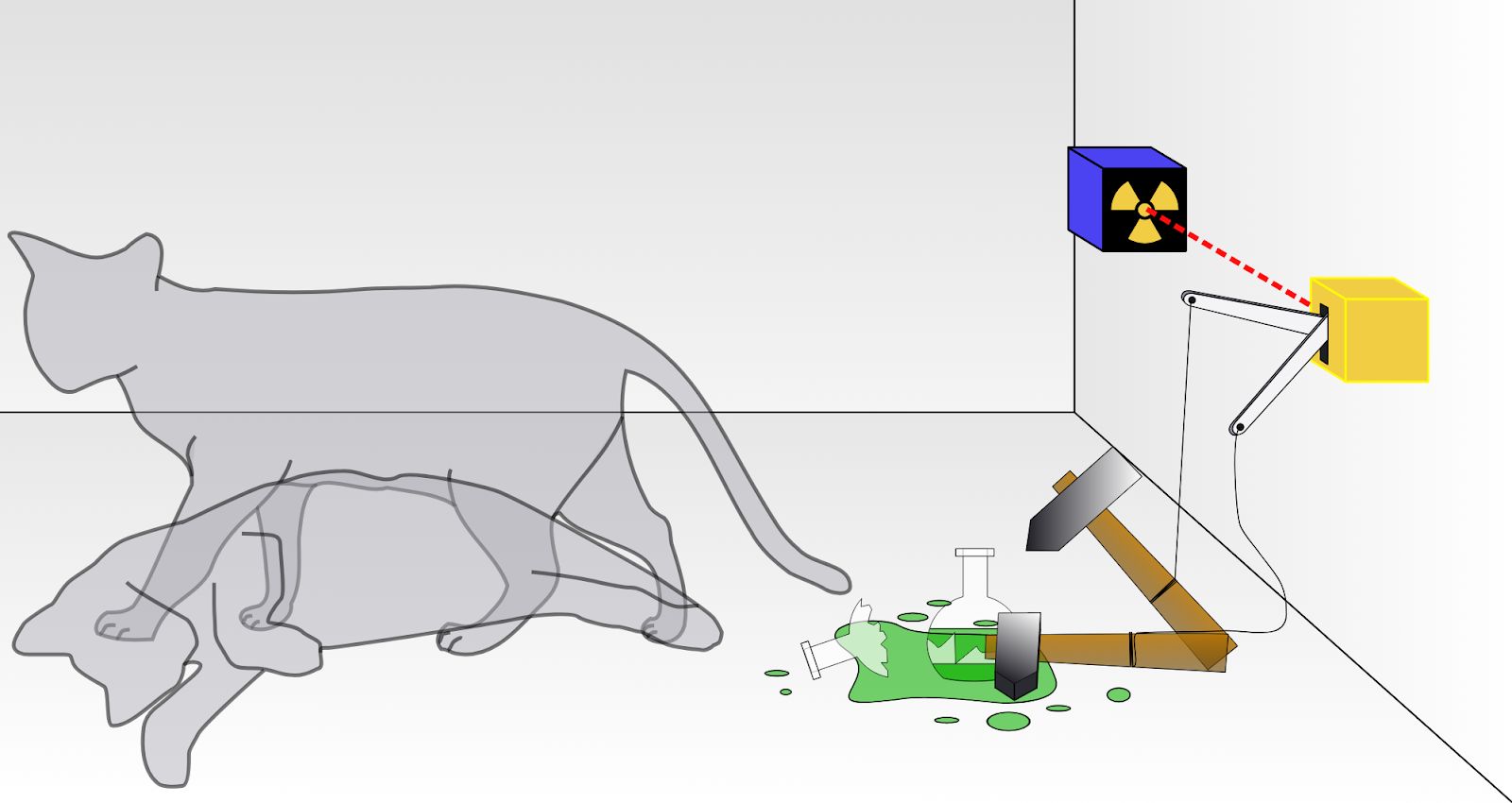

In quantum mechanics, there’s a famous thought experiment called Schrödinger’s Cat.

A cat is placed in a sealed box, along with a vial of poison and a radioactive atom. If the atom decays, the poison is released and the cat dies. If not, the cat lives. But until you open the box, the cat exists in a state of quantum superposition: simultaneously both dead and alive.

Bitcoin’s recent all-time high finds itself in a similar paradox.

Open your chart in U.S. dollars and you’ll see Bitcoin at a record high: $123,000, up nearly 30% on the year. The cat is alive.

But switch to euros, pesos, or reais, and the state changes. BTC hasn’t broken past the January highs. The cat is dead.

Bitcoin is simultaneously at an all-time high… and not.

This forces the question: Is this rally a story of Bitcoin’s intrinsic strength, or merely an illusion created by the fundamental decay of the world’s reserve currency?

Let's open the box.

🧶 Why Did Bitcoin Hit a New ATH?

First, let's understand what happened. A confluence of powerful, US-centric forces combined to send Bitcoin to its new USD ATH:

ETF Inflows: Bitcoin ETFs have absorbed over $50B in net inflows. Cumulative spot ETF volumes have crossed $1T. Institutions are finally buying: pension funds, asset managers, and allocators that once sat on the sidelines are now rushing in.

Corporate & Government Buyers: Over 125 U.S. companies now hold BTC on their balance sheets, collectively adding a record 159,107 BTC in Q2 2025. MicroStrategy alone owns 601,550 BTC. Arizona and New Hampshire have passed laws to hold BTC as treasury reserves, and the U.S. government is next up on the plate.

U.S. Policy Tailwinds: Trump’s administration has gone full pro-crypto, with bills advancing and clear support from the top. This week was even branded as “Crypto Week” in Washington, as lawmakers voted on three high-profile crypto bills.

Interest Rates & Inflation Fears: Rate cuts are coming. Fed futures price in 3 cuts by year-end. With inflation still a concern, BTC shines as a hedge, and a bet on sound money.

To keep it simple, demand far outpaced supply in a bullish macroeconomic environment while Bitcoin continues to cement its role as the digital reserve asset of the 21st century.

🐆 The Anatomy of a Dollar Denominated Rally

So yes, Bitcoin hit a new record price…

But just like Schrödinger’s Cat exists in a state of superposition (dead and alive), the all-time high is both true and false, depending on where you’re looking from.

In USD, BTC clearly broke through the previous ceiling on July 14, 2025. The last ATH, before all of the recent breaks, was back in late January. We’re now 12% above that.

But this is a dollar-centric view of a borderless asset. When swapping the denominator, we kill the cat.

What appears to be a breakout is, in many cases, just another pump. So let's look at the numbers. Here’s Bitcoin’s latest rally around the world: