- Frontera by Bando

- Posts

- 🎄 End of Year at Frontera

🎄 End of Year at Frontera

Our top 5 essays and episodes

Real problems. Real solutions. Real data. This is Frontera.

Your weekly dose of data-driven crypto insights from the edges of the world. Trusted by leaders at Bitso, Binance, the Solana Foundation, the Ethereum Foundation, and more.

This is where you start if you’re building, investing, or scaling in frontier markets.

This Edition Is Brought To You By Bridge

Bridge makes it simple to receive, hold, issue, and use stablecoins. Unlock new markets, launch new products, and make money move. Discover how at bridge.xyz

🧑🎄 Thank You For Reading Us This 2025

Merry Christmas and Happy New Year to everyone reading this!

As the year comes to a close, I wanted to pause, look back, and say thank you.

2025 was an amazing year for Frontera. We wrote over 72,000 words, reached 25,000 total impressions, and grew the newsletter from 106 subscribers to more than 2,800, a 2,600% increase in a single year.

Words can’t fully express my gratitude. Thank you to each and every one of you for reading every week and for allowing me to do what I love.

To close out the year, we put together a recap of our top five essays and podcast episodes. Let's get it.

📚 Top Frontera Essays of 2025

This essay introduces a new model for moving money on crypto rails, replacing the traditional fiat → USD stablecoin → fiat flow with a local-first system built on local stablecoins and onchain FX. It explains why routing everything through the dollar creates inefficiencies for emerging markets and how direct local currency swaps unlock capital efficiency, monetary relevance, and new financial infrastructure across Latin America.

It earns its place on this list for clearly articulating one of the most important structural shifts underway in stablecoins and cross-border payments.

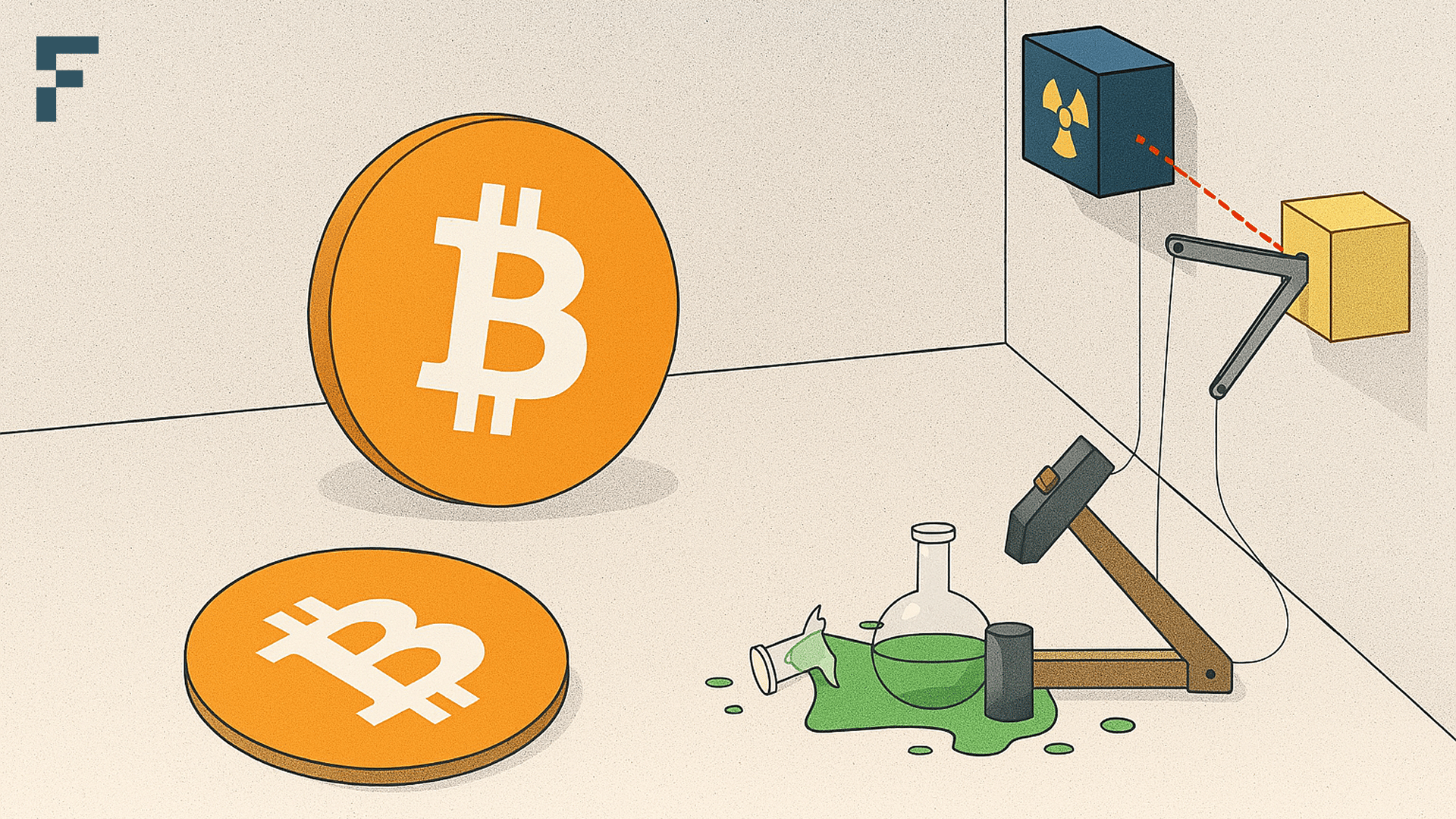

Bitcoin hit a new all-time high in U.S. dollars while failing to do so in many other currencies, exposing a deeper truth about how price is perceived. Using Schrödinger’s Cat as a metaphor, the essay compares BTC across fiat pairs and against gold to show how much of the rally was driven by dollar weakness rather than universal strength.

Ranked fourth, it stood out for reframing a headline moment into a sharp analysis of denominators, currency decay, and what an “all-time high” really means.

“How simple things were when our messiah was only a dream,” says Stilgar in Dune Messiah, reflecting on how prophecy turns into responsibility once it is fulfilled. This essay uses that idea to frame crypto’s evolution, from a rebellious dream of freedom from institutions to a reality where Bitcoin sits in government reserves and institutions build directly on crypto rails.

Ranked third, it stood out for capturing the emotional shift of the industry and asking the harder question of what comes after winning.

In the 16th century, conquest rode the wind on sails of empire. In the 19th, it thundered in on rails and rifles. In the 20th, it flowed with oil and flew from distant airbases. Now, on the 21st, it spreads through stablecoins, allowing the US to export its debt, reinforce dollar hegemony, and quietly colonize emerging markets.

Placed near the top of this year’s list, this special edition essay earned its place by tracing how America is weaponizing digital dollars through a new form of techno-economic conquest, and by laying out the stark choices this shift leaves for emerging economies.

This one was kind of a no contest. The depth, scope, and effort behind Fintech 3.0 made it the clear standout of the year and the most complete piece we’ve ever published.

Built on months of research, conversations with thousands of users, and hundreds of discussions with fintech leaders across the ecosystem, the report traces how finance is shifting from banks and software layers to open, programmable infrastructure powered by stablecoins and blockchains.

Grounded specifically in Mexico, it explains why the country is uniquely positioned to lead this transition and offers a practical framework for investors, builders, and fintech operators navigating the next phase of financial services.

📺 Top Frontera Episodes of 2025

#5 - Manuel Godoy (Felix Pago)

Manuel Godoy, co-founder and CEO of Félix Pago, breaks down how Félix turned WhatsApp into a remittance product that matches the “human” experience Latinos in the U.S. still seek at physical remittance stores, while running on blockchain rails quietly in the backend.

The episode earned the #5 spot because it’s one of the cleanest real-world, successful stablecoin case studies with wild, wild numbers you should hear for yourself.

#4 - Ben Reid (Bitso & Juno)

Ben Reid, Head of Stablecoins at Bitso and Juno, explains why local stablecoins matter, how onchain FX cannot exist in a dollar-only world, and why the next phase of stablecoin adoption will move from institutions down to retail.

It stood out for clearly articulating the strategic case for MXNB and local currencies as financial infrastructure, inspiring us to write the Stablecoin Sandwich essay.

#3 - Santiago Roel (Inversion)

This episode features Santiago Roel, founder of Inversion Capital, discussing his transition from investor to operator and his playbook of acquiring other real-world businesses to onboard a billion users into crypto.

It earned its spot for laying out one of the clearest strategies for mass adoption in Latin America, grounded in distribution, unit economics, and execution.

#2. Keone Hon (Monad)

We recorded this special in-person episode with Keone Hon, co-founder and CEO of Monad, in Mexico City, where he explains what Monad is building and why high-performance, EVM-compatible blockchains matter for real adoption.

It earned its spot near the top for capturing Monad’s technical vision straight from the source, while clearly articulating why Latin America matters as a priority market and how serious protocols think about builders, community, and long-term growth.

#1 - Zach Abrams (Bridge)

Zach Abrams, co-founder and CEO of Bridge, recently acquired by Stripe for $1.1B, takes the top spot as he breaks down Bridge’s story, the acquisition, and what stablecoins unlock for payments.

It earned #1 because he explains, from the inside, why Latin America became a real growth engine for Bridge and what builders in the region are actually shipping. This one is definitely a must watch.