- Frontera by Bando

- Posts

- 🕵🏻♂️ Why the Market Slept on CETES for a Decade

🕵🏻♂️ Why the Market Slept on CETES for a Decade

A global bond fable part 2

📜 A Global Bond Fable

In our previous essay, A Global Bond Fable, we showed how CETES (2.52x) outperformed T-bills (1.67x) and the USD (1.38x) over 15 years, and ended with the following observation:

“The 2.5x return happened while 86% of the market remained locked in domestic institutional hands, with virtually no participation from hedge funds, sovereign wealth funds, or global allocators. It seemed like the market slept on this trade for at least a decade.”

It raised two questions that demanded more of our time:

If the performance was that good, why didn't more people notice?

More importantly, who did?

And we couldn't abandon the topic without answering them.

What should have been a globally discovered outperformance trade became a locally trapped structural mispricing that persists today.

What follows is the breakdown of who owns CETES, compared to the T-bill ownership distribution, and what that reveals about why the trade went unnoticed for so long.

Haven’t Downloaded Our Fintech 3.0 Report Yet?

A 58-page deep dive into how finance is being rebuilt on new rails, and why we’re at the beginning of a major technological platform shift that will reshape how financial products are built and scaled in Mexico. Download your copy here now.

🇲🇽 CETES Ownership Breakdown

Before diving into the numbers, I'd like to give more context to our international audience: CETES are short-term zero-coupon government bonds (28, 91, 182 days, and 1-2 years), the oldest and most liquid instrument issued by the Mexican government.

They represent a subset of total government securities, which also include longer-dated Bonos, inflation-linked Udibonos, and floating-rate Bondes. We focus on CETES because they're the benchmark for short-term rates and the primary vehicle for foreign participation in Mexican sovereign debt.

Now we can continue.

The CETES market more than doubled in size over the decade, growing from approximately MXN 1.03T ($66.5B) in mid-2015 to MXN 2.59T ($127B) by the end of 2025.

Yet the most striking transformation, and what we will talk about today, is not size but composition.

To partly answer question number two let's look at the ownership breakdown for Mexican government securities:

Foreign investors, who held roughly 36% of all Mexican government securities in early 2015, collapsed to just 13.6% by March 2025, a near-total withdrawal from what was once a cornerstone of emerging-market carry trades.

The decline began gradually after foreign ownership peaked at 38.9% in January 2015. It accelerated sharply during COVID, and continued through 2024-2025 as Banxico's rate-cutting cycle narrowed the yield spread with the Fed from 575 basis points to roughly 325 basis points.

🇺🇸 T-bills Ownership Breakdown

The U.S. Treasury market roughly doubled from $15.1T (Q4 2015) to $26.8T (Q2 2025), while gross federal debt ballooned from $18.1T to approximately $38.7T.

The ownership structure shifted substantially, though less dramatically than in Mexico:

It's important to note that the percentages shown represent ownership of debt held by the public, which accounts for 80% of total gross federal debt. The remaining 20% is intragovernmental debt, which simply represents money the government owes to itself.

And yes the chart shows different categories as the CETES ownership distribution, but the primary variable we want to compare is foreign holdings of U.S. Treasuries, which grew in absolute terms but fell as a share because total issuance grew faster.

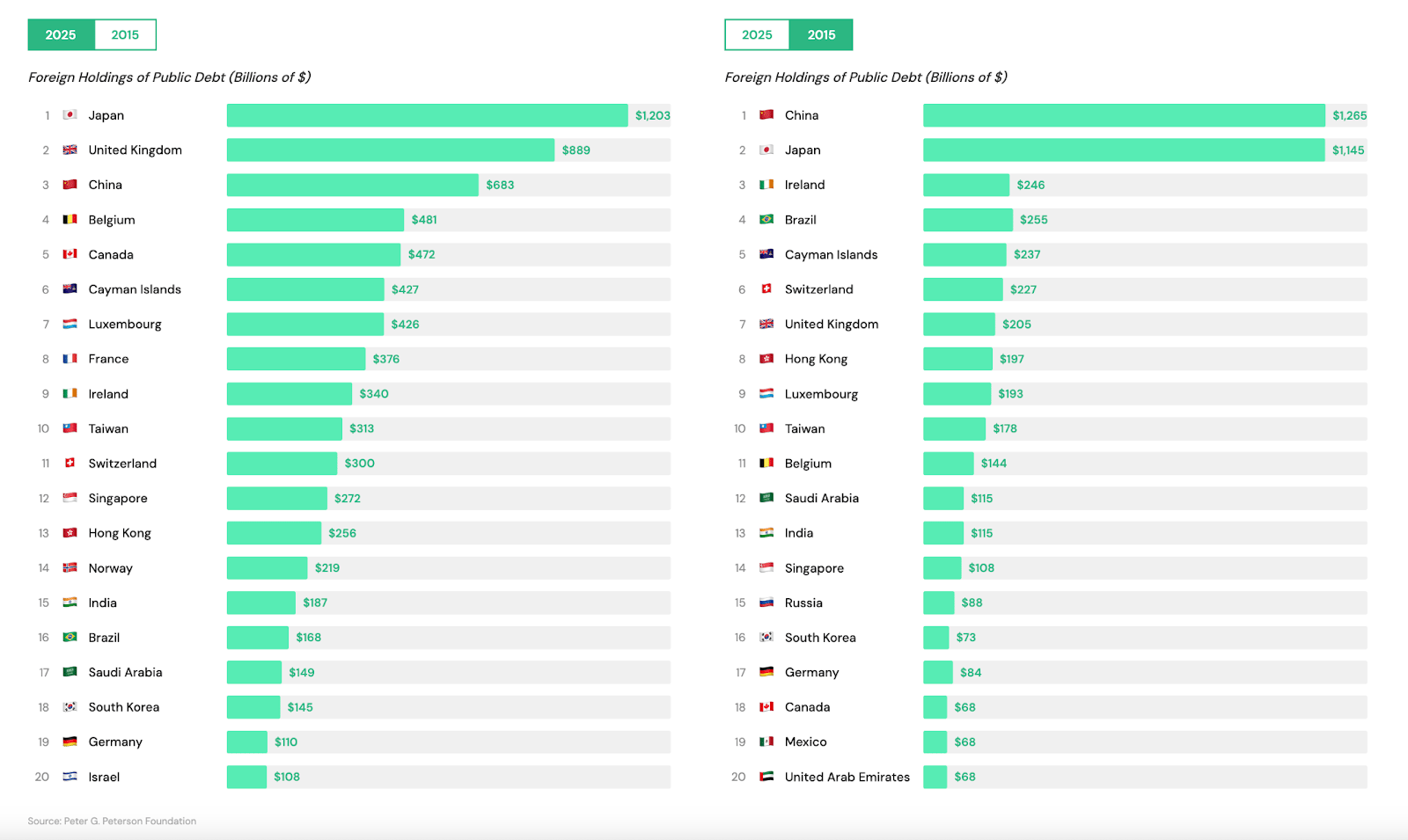

2025 on the left.

In 2015, foreign investors held approximately $6.1T. By 2025, that figure reached $9.3T. Unlike Mexico the problem wasn't capital flight, it was that the U.S. issued $13T in new debt over the decade, and foreign buyers only absorbed $3.2T of it.

The decrease in foreign holdings as a percentage can be explained by two structural trends: issuance growing extremely fast during COVID and fiscal expansion, and the growing global trend of avoiding complete reliance on the United States.

China's rise as a superpower has prompted countries to diversify reserves. Central banks are now hoarding gold in record numbers, global official reserves reached 36,700 tonnes by end-2024, the highest in three decades, with central banks adding over 1,000 tonnes annually since 2022.

Even though the USD remains dominant, countries want options.

But for me, Mexico's 22-percentage-point collapse in foreign ownership is too dramatic to explain away with denominator effects or strategic diversification.

There had to be another answer. Because it couldn't be that people didn't want a free 2.52x, or that the world suddenly stopped wanting to invest in Mexico.

So I kept digging.

🔎 The Real Reason Foreign Ownership “Disappeared”

Despite the reduction in direct bond holdings reported by Banxico, Mexico registered its highest portfolio investment inflows since 2012 in 2025, confirming that appetite for Mexican assets remains active.

The country shattered its foreign direct investment record in 2025, attracting $40.9B in the first three quarters alone, a 14.5% jump from the prior year and already exceeding the full-year 2024 total of $36.8B (that's a higher low if I've seen one).

Now here comes the answer for question number one. Foreign investors didn't exactly abandon the CETES trade, they changed how they accessed it. As Janneth Quiroz, Director of Economic Analysis at Monex, explains:

"The decline in physical bond holdings doesn't imply capital flight, but rather a change in the architecture of international investment. Foreign investors have migrated from direct ownership of government debt toward synthetic instruments and derivatives, particularly in over-the-counter markets, which allows them to capture returns with greater flexibility and lower operational costs."

In other words, instead of buying Mexican bonds directly, many foreign investors now use financial contracts that replicate those returns without holding the bond itself.

This shift reflects a broader evolution in finance. Swap agreements, total return swaps, and structured products allow institutions to gain peso-rate exposure without the friction of settling in Mexico, dealing with Indeval (Mexico's securities depository), or navigating local custody arrangements.

It's cheaper, faster, and to our surprise, invisible to Banxico's ownership statistics.

So some investors were indeed exposed to the trade all along.

🏗️ The Infrastructure That Should Exist

The assets are just held differently now, as finance underwent what we describe in our Fintech 3.0 report as a technological platform shift that renders previous infrastructure obsolete.

And whatever countries and fund managers are using right now will be replaced by tokenized real-world assets in less than two years.

Which brings us to the final piece.

The easiest method for anyone to gain exposure to the CETES trade today is through Etherfuse's tokenized CETES Stablebonds via our Bando treasury management portal.

Etherfuse takes physical CETES and issues dollar-stablecoin equivalents that settle instantly onchain. The tokens are backed 1:1 by actual government securities, fully auditable, and redeemable at any time.

Bando provides the institutional-grade interface to access these tokens and add 520 basis points over U.S. Treasuries directly into your working capital, integrating with existing operations, and settling onchain, all without navigating Cetesdirecto's retail platform or establishing relationships with Mexican brokerages.

If you're an allocator, treasury manager, or fund looking to access this market, reach out to us here.