- Frontera by Bando

- Posts

- 🇦🇷 Uniswap Cup: Fútbol Meets Crypto

🇦🇷 Uniswap Cup: Fútbol Meets Crypto

And there's a new BTC treasury in town

Real problems. Real solutions. Real data. This is Frontera.

Your weekly dose of data-driven crypto insights from the edges of the world. Trusted by leaders at Bitso, Binance, the Solana Foundation, the Ethereum Foundation, and more.

This is where you start if you’re building, investing, or scaling in frontier markets.

Reading this by email? Click Read Online in the top right corner to view the full edition.

And don't miss this week's podcast where we predict the winner of the Uniswap Cup and further break down this week's news.

🇦🇷 Uniswap Cup: Fútbol Meets Crypto

It's finally time to touch grass, the Uniswap Cup is here.

On November 16th in Buenos Aires, a day before Devconnect, fútbol meets crypto. The Uniswap Cup will bring together 32 10-man teams for a single day, winner takes all, football tournament featuring your favorite crypto protocols.

Uniswap, Ethereum, Arbitrum, Optimism, Aave, Ledger, you get it. The best of the best.

And of course, that includes yours truly, Espacio Cripto and Odisea.

Apply to join a club and get drafted here. Just to let you know, if you're a sweeper center back, a midfield maestro or a killer 9 with the mythical instinto goleador.

We've got spots open.

🇧🇷 There's a New BTC Treasury in Town

By town I mean Latin America, and by new BTC treasury I mean 6x larger than the previous biggest one in the region.

OranjeBTC is scheduled to begin trading on the Brazilian stock exchange B3 next week, bringing 3,650 BTC ($420M) into public markets through a reverse IPO.

Backed by household industry names, Ricardo Salinas, the Winklevoss twins, FalconX, and Adam Black, the company is structured as a Bitcoin treasury vehicle, giving traditional investors regulated exposure to BTC without touching exchanges or wallets.

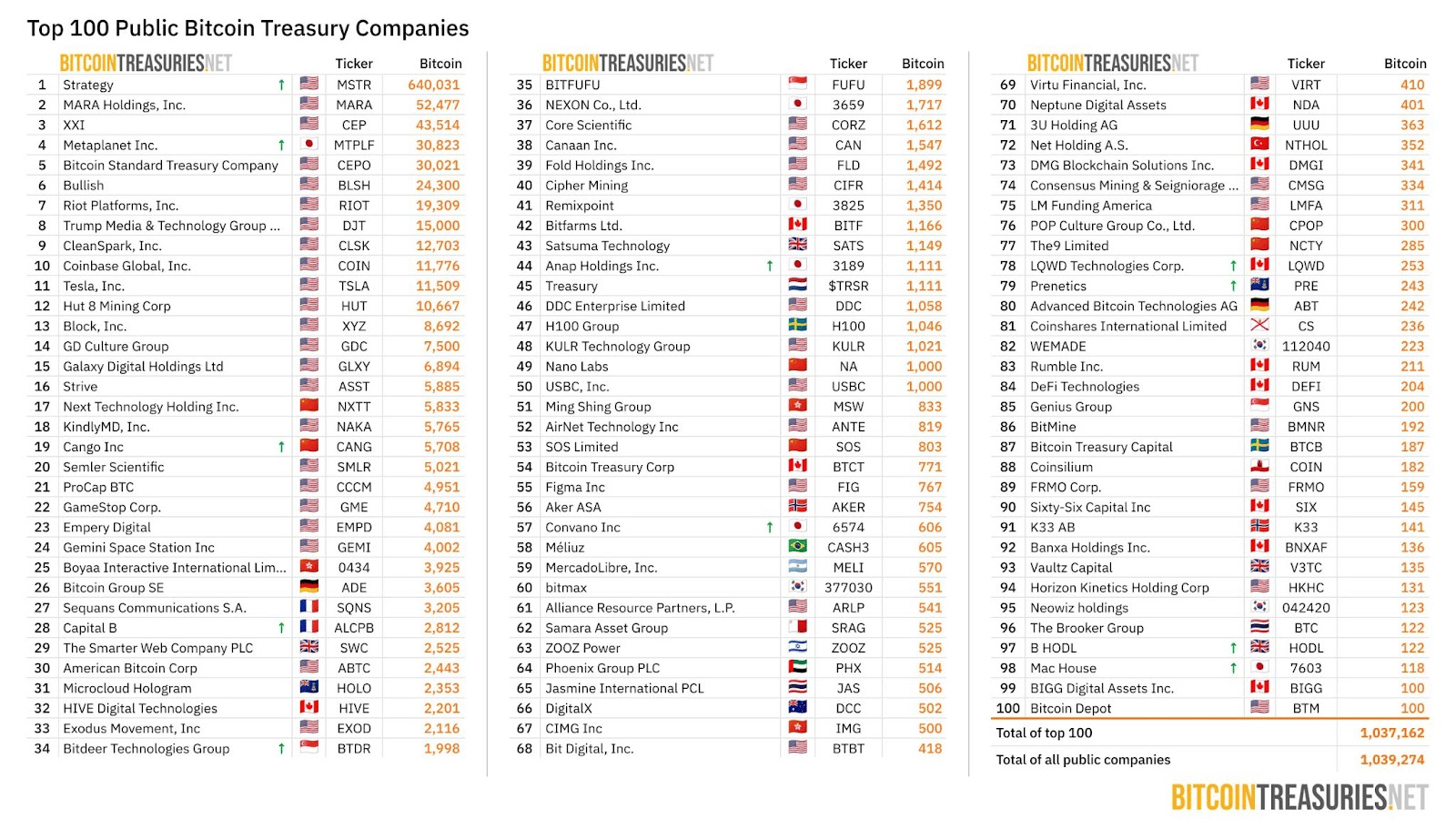

Its entry via the merger with Intergraus marks the largest Bitcoin treasury firm ever to trade on a Latin American exchange, dwarfing Meliuz’s 605 BTC ($72M).

OranjeBTC now ranks as the largest BTC treasury in LatAm and rank #26 worldwide among publicly traded firms.

🇧🇷 Brazil

Brazil’s Banco Safra unveiled Safra Dollar, a USD-pegged token fully backed 1:1 and run on its own blockchain, giving Brazilians a new, regulated way to dollarize savings with D+1 liquidity.

At DAC 2025, ex–Brazil CB chief & now Nubank VP Roberto Campos Neto said central banks are wrong to isolate crypto. Stablecoins are booming in emerging markets, integration is the only path.

🇲🇽 Mexico

Clara and Bitso Business team up to offer corporate cards and payment services backed by stablecoins, giving Mexican firms a simpler way to fund operations.

Bitso is reportedly exploring the purchase of CIBanco, one of the Mexican institutions flagged by the U.S. for alleged money laundering, possibly including its banking license.

🇨🇴 Colombia

Fecoljuegos, Colombia’s gambling industry association, urged regulators to block Polymarket, accusing it of illegal crypto betting on elections and risking democratic integrity. Quite ironic.

🇸🇬 Singapore

“What’s missing is all the non-dollar currencies,” said Base’s Jesse Pollak at Token2049, urging builders to launch local stablecoins to unlock real global adoption.