- Frontera by Bando

- Posts

- 🧪 The Nativity Premium

🧪 The Nativity Premium

What it takes to thrive in LatAm’s crypto markets

Real problems. Real solutions. Real data. This is Frontera.

Your weekly dose of data-driven crypto insights from the Latin American frontier. Trusted by leaders at Bitso, Binance, the Solana Foundation, the Ethereum Foundation, and more.

This is where you start if you’re building, investing, or scaling in LatAm.

Reading this by email? Click Read Online in the top right corner to view the full edition. Or listen to the full episode here.

And don't miss this week's guest podcast with Romina Sejas, from ETH Latam and ETH Kipu, where she breaks down how to create community and the cultural differences between Brazil and Argentina.

This Edition is Presented by Bitso’s Stablecoin Conference

Frontera is an official media partner of Bitso’s Stablecoin Conference 2025.

We’ll be on the ground in Mexico City this August 27–28, covering the builders, the breakthroughs, and ideas reshaping LatAm’s financial future.

Use the code FRONTERA10 for 10% off your ticket here. See you there.

🧬 Founder-Led Outperformance

A recent LinkedIn post by Jason Yanowitz, Co-Founder at Blockworks, proposed a simple investing strategy: “Only invest in stocks where the founder still runs the company.”

It got me thinking.

Do founder-led companies in the S&P 500 actually outperform the index? By how much? And why?

More importantly: in crypto, an industry where almost every major protocol is founder-led by default, what's the equivalent edge if founder leadership is the norm?

Today, I'll answer those questions and introduce a new concept, adapting this phenomenon to Latin America’s crypto startup scene: The Nativity Premium.

🔬 Beating the S&P

First, let’s quantify the founder factor in traditional markets.

Yano wasn't the first to think of this idea. Back in 2016, Bain & Company ran the numbers. Their research showed that from 1990 to 2014, founder-led companies outperformed the S&P 500 by 3.1x.

Honestly, that's quite a lot. But it's still a different era with different companies and different metas. Let's bring it closer to today.

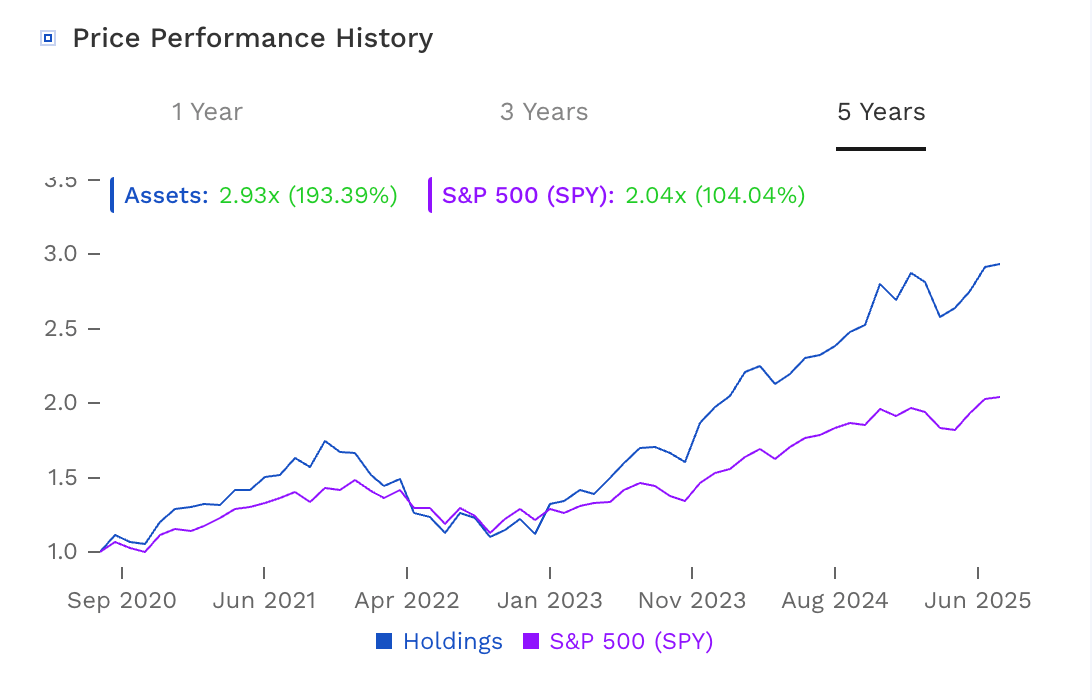

We ran the same analysis using Finbox data from 2020 to 2025. The gap narrowed, but the edge held: founder-led companies still outperformed the S&P 500 by 2.04x.

Why do they outperform?

It boils down to a mix of aligned incentives, agility, and vision.

Founders typically hold significant equity stakes, so their net worth is directly tied to their company’s fate, focusing their efforts on long-term value creation.

They’re also wired to innovate. Founder-CEOs generate 31% more patents than hired managers, and are far more likely to swing for the fences. They build to survive.

That includes simply making the hard choices and sticking to a long-term mission when professional managers might play it safe. They act like owners, which often means less bureaucracy, faster decisions, and a bias toward innovation over complacency.

In short, a founder’s deep knowledge of the business, skin in the game, and execution for the future combine to drive superior performance.

Remember these three things: deep knowledge, skin in the game, and execution, as they'll come in handy in a bit.

Given this founder premium in traditional equities, Yano’s instinct to back founder-led stocks makes sense.

But what about crypto, where virtually every project is founder-led? After all, Bitcoin had Satoshi, Ethereum has Vitalik, Binance has (had?) CZ. If all crypto investments start out (and end) founder-led, then leadership alone isn’t a differentiator.

So what is?