- Frontera by Bando

- Posts

- 🔍 How stablecoins are moving from niche tools to mainstream finance

🔍 How stablecoins are moving from niche tools to mainstream finance

Our analysis of Bitso’s stablecoin report 2025

Real problems. Real solutions. Real data. This is Frontera.

Your weekly dose of data-driven crypto insights from the edges of the world. Trusted by leaders at Bitso, Binance, the Solana Foundation, the Ethereum Foundation, and more.

This is where you start if you’re building, investing, or scaling in frontier markets.

Reading this by email? Click Read Online in the top right corner to view the full edition. Or listen to the full episode here.

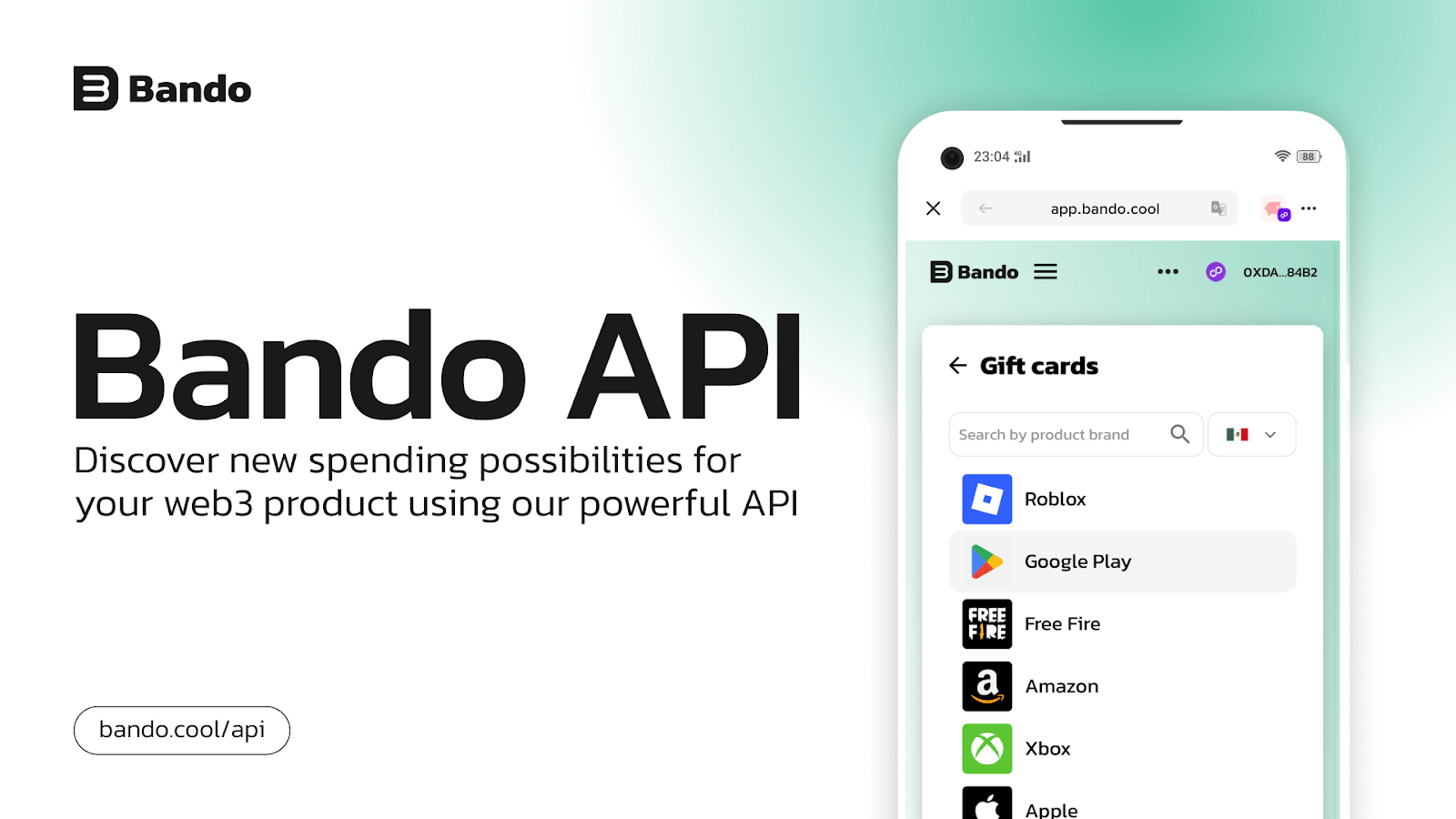

This Edition is Presented by Bando

With Bando, you can turn any wallet or dApp into a real payments tool. Integrate our API or widget and let your users spend crypto on thousands of products, services, and gift cards—without dealing with logistics or regulation. From mobile top-ups to ecommerce, travel, gaming and groceries, Bando unlocks new revenue streams while boosting user loyalty through practical, global use cases. 🚀

👉 Learn more at Bando Business

🔍 How stablecoins are moving from niche tools to mainstream finance

What's up?, Rivv here, and today I want to talk to you about how stablecoins are becoming a mainstream financial tool. Join me in 3… 2… 1…

The first half of 2025 has positioned Latin America as one of the most dynamic laboratories for stablecoin adoption worldwide. What began as a niche tool for traders and remittance operators is rapidly transforming into a multi-industry financial backbone. Bitso Business’ latest report offers a clear picture: stablecoins are no longer a speculative experiment, but a structural force shaping how money moves across the region.

From alternative to infrastructure

Stablecoins have traditionally been marketed as a faster and cheaper alternative to traditional banking rails. But the report suggests the narrative is shifting. In markets plagued by inflation and regulatory barriers, businesses now see stablecoins as infrastructure, not just instruments. Liquidity, interoperability, and integration with credit and payment systems are emerging as critical priorities. Without them, stablecoins risk remaining in silos—efficient within their own pools but disconnected from the broader financial system.

Explosive growth beyond remittances

Bitso Business processed record volumes in the Mexico–U.S. remittance corridor, with stablecoin transactions doubling between late 2024 and mid-2025. Yet the real story lies in diversification. Payment aggregators grew by 68%, while gaming companies expanded more than fivefold. These verticals highlight how stablecoins are powering industries where speed and cost efficiency are existential advantages.

The evolution of use cases is equally revealing. For the first time, treasury operations, FX conversions, and arbitrage flows surpassed remittances, representing 45% of all processed volumes. Companies are holding reserves in dollar-pegged assets, converting currencies without banking delays, and leveraging regional arbitrage opportunities. In short, stablecoins are becoming a treasury tool, not just a remittance channel.

Regional winners and emerging players

Geographically, Mexico continues to dominate with nearly half of all stablecoin flows, but Brazil, Colombia, and Argentina are catching up. The growth in these markets suggests a broader regional appetite for stablecoin-based solutions. Even countries at early adoption stages are moving beyond simple remittance cases, hinting at long-term structural change.

The strategic horizon

The report’s most striking insight is the call for “USD baskets” — composite assets that unify liquidity from multiple dollar-pegged tokens. Such innovations could address the fragmentation risk that currently limits scale. Moreover, the leaders in this space will not resemble traditional startups; they will operate like trading firms, managing liquidity desks, building FX-grade infrastructure, and serving institutions with precision.

The underlying message is clear: stablecoins are no longer competing with banks on speed or cost. They are redefining what financial infrastructure looks like in emerging markets. Customers, as the report notes, do not care about the mechanics; they care about money arriving safely, quickly, and cheaply. Stablecoins deliver exactly that, while opening the door to programmable, global, and inclusive finance.

Final take

The first half of 2025 marks a turning point: stablecoins have crossed from potential to permanence in Latin America. As regulation matures and infrastructure strengthens, the second half of the year may well confirm what industry insiders already know—stablecoins are not an alternative financial tool. They are the rails upon which the next generation of commerce will run.

🌐 Frontier Markets Crypto News

MoneyGram now uses Crossmint to let users receive and store USDC instantly, with the option to cash out to local currency. A big step in evolving global remittances.

A 6-week equity-free program with support from Ethereum Foundation, Mantle, AUSD, Alchemy & more. 8-10 teams will scale fast and pitch at Demo Day during Devconnect Argentina. Apply by Sept 25.

Latin America’s largest digital bank will integrate stablecoins into its credit cards, aiming to link crypto with traditional banking as adoption surges across the region amid inflation.

The partnership lets LatAm companies use stablecoins as collateral for payments, giving faster, more stable, and controlled access to Clara’s full corporate finance ecosystem.