- Frontera by Bando

- Posts

- 🗡️ Our Take on the Current State of Crypto

🗡️ Our Take on the Current State of Crypto

The one time we talk prices

Real problems. Real solutions. Real data. This is Frontera.

Your weekly dose of data-driven crypto insights from the edges of the world. Trusted by leaders at Bitso, Binance, the Solana Foundation, the Ethereum Foundation, and more.

This is where you start if you’re building, investing, or scaling in frontier markets.

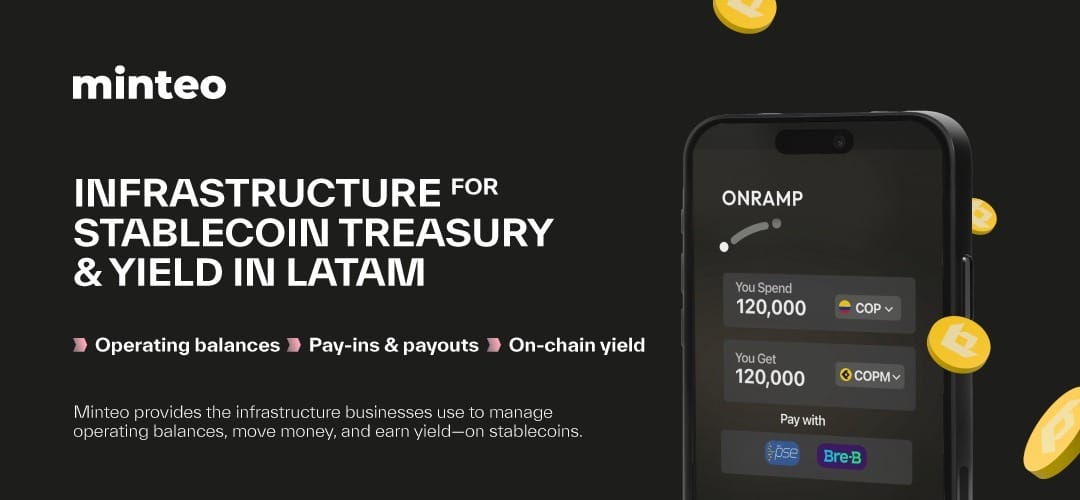

This Edition Is Brought To You By Minteo

Minteo provides the infrastructure businesses use to manage balances, move money, and earn yield on stablecoins. Discover how at minteo.com.

🗡️ On the Current State of Crypto

We don’t usually spend much time talking about price. Mostly not at all really, but this week's episode opened with a sober assessment of the recent market downturn as Bitcoin and the broader crypto market experienced a rather sharp correction.

I'd recommend you to check it out, but for now, here's what was said.

To give some context (even though most of you are probably well informed), over the past week, Bitcoin fell roughly 25%, while Ethereum dropped more than 35%, pushing BTC to the mid-$60,000 range and ETH below $2,000.

On paper, those numbers look brutal. In practice, the reaction depends entirely on time horizon.

For those who remember BTC at $2,000 or even $20,000 in 2023, current levels still represent extraordinary appreciation. Discomfort stems less from absolute price levels and more from psychological anchoring after it traded near six figures, and also from most of the timeline chopping themselves to death via altcoins.

Now, this is what Simon, Head of Growth at Alliance, and Cush, Founder of Odisea Labs, had to say about the price action…

Simon’s Take

For Simon, nothing about this move feels new. A 20% drawdown is significant given Bitcoin’s current market cap, but structurally it’s business as usual.

Bitcoin has always moved in violent cycles, and holding it is ultimately a privilege reserved for those with both emotional stability and long-term capital. These are still just unrealized losses, just as past gains were paper profits until sold.

The core mistake people do, he argued, is obsessing on short-term price action rather than focusing on accumulation. Narratives change, sure, but at a deeper level, fundamentals don't.

As Naval once said, we have to “play long-term games with long-term people”. This is one of those games.

Zooming out further and now talking about the difference in builders during bull/bear markets, Simon describes bear markets as moral sorting mechanisms.

Bull markets attract mercenaries chasing returns; bear markets leave behind missionaries building out of conviction.

Founders who stay are often driven by deeper motivations. When prices fall, those here for the wrong reasons simply move on, something we’re clearly seeing as attention shifts to AI.

Everything he said can be summarized to just one word: patience. Patience remains the edge.

Cush’s Take

Cush largely agrees with the accumulation thesis, but approaches it from a more tactical angle.

Having exited positions earlier after the 10/10 (what did he know?), he views the current drawdown as a natural continuation of a broader cycle rather than a surprise.

From his perspective, markets may still be three to six months away from a true bottom.

He framed this period as another industry-wide reckoning. Layoffs, tighter capital, and changing corporate structures force crypto to confront the same recurring question: what is this technology actually for?

If you don't know the answer, you can find what you seek in our previous Frontera editions.

Haven’t Downloaded Our Fintech 3.0 Report Yet?

A 58-page deep dive into how finance is being rebuilt on new rails, and why we’re at the beginning of a major technological platform shift that will reshape how financial products are built and scaled in Mexico. Download your copy here now.

🪙 Stablecoins

Blindpay processed $306M in TPV in January 2026 alone, after growing from $900K in 2024 to $503M in 2025.

Alfred closed a $15M Series A led by F-Prime Capital, Brevan Howard Digital and White Star Capital to strengthen infrastructure, expand payment corridors and deepen bank integrations across Latin America.

Tether delivered $10B in profits in 2025, held $6.3B in excess reserves, and reported a record $141B exposure in U.S. Treasuries, underscoring its massive scale and reserve strategy.