- Frontera by Bando

- Posts

- 🐢 🐇 A Global Bond Fable: The Tortoise (MX CETES) and the Hare (T-bills)

🐢 🐇 A Global Bond Fable: The Tortoise (MX CETES) and the Hare (T-bills)

Why Mexican government bonds have outperformed T-Bills

Real problems. Real solutions. Real data. This is Frontera.

Your weekly dose of data-driven crypto insights from the edges of the world. Trusted by leaders at Stripe, Paradigm, Binance, the Ethereum Foundation, and more.

This is where you start if you’re building, investing, or scaling in frontier markets.

This Edition Is Brought To You By Minteo

Minteo provides the infrastructure businesses use to manage balances, move money, and earn yield on stablecoins. Discover how at minteo.com.

This essay is a collaboration between Bando and Etherfuse, soon you’ll be able to access CETES through Bando’s institutional-grade treasury management platform powered by Etherfuse’s Stablebonds.

Talk to us here to learn more.

🏜️ The Golden Era of CETES

Over the past fifteen years, Mexican government bonds (CETES) have quietly delivered one of the most compelling fixed income stories in global markets.

To your surprise (probably), just as the turtle beat the hare, CETES have outperformed U.S. Treasury bills and beat dollar holdings, compounding at a rate that turned 1 peso in 2010 into 2.52 pesos by the end of 2025, a 152% return that crushed both alternatives.

In today’s Frontera history class: A Global Bond Fable, you will learn how, and why this happened.

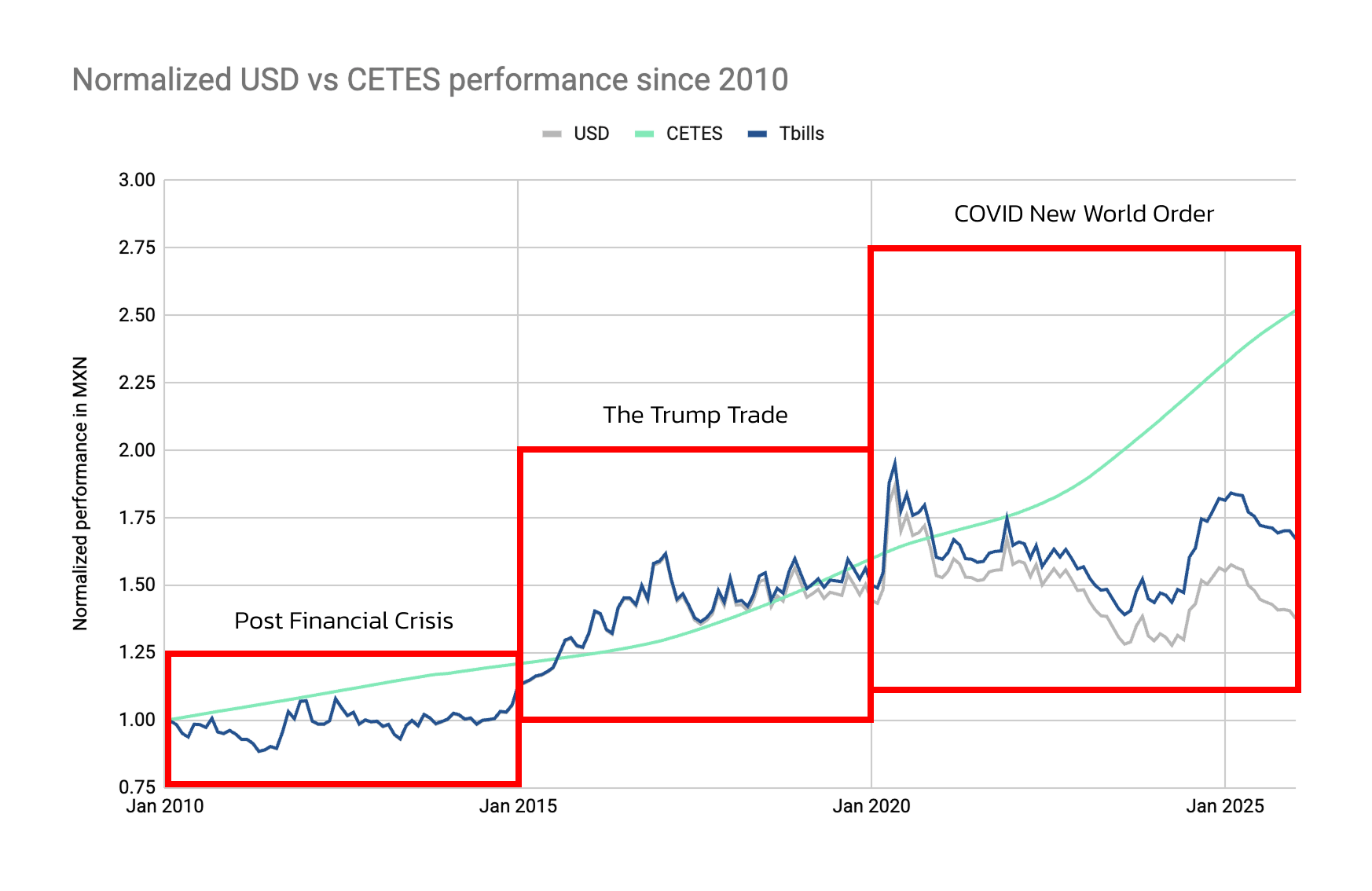

We will tell the story through our Normalized USD vs CETES Performance Since 2010 chart across three timeframes. As you can see, overall, CETES have climbed steadily upward, while T-bills track sideways with occasional spikes, and the dollar meanders, buffeted by exchange rate swings.

The answer to the outperformance lies in a simple three-sided framework of interest rates and the exchange rate.

Mexico has structurally higher rates than the U.S. because it carries higher inflation expectations, greater sovereign and currency risk premiums, and a smaller, less liquid capital market that requires offering investors additional yield to attract and retain capital.

Mexico's structurally higher rates compound during periods of stable or strengthening MXN.

When the U.S. raises rates aggressively, Mexico has to increase rates even further to retain capital and continue attracting foreign investment.

As a result, the only scenario in which a T-Bill clearly outperforms a CETE is when the U.S. dollar significantly strengthens against the Mexican peso. Which occurred during specific windows over the past 15 years.

Post-COVID dynamics amplified these forces, creating what amounts to a golden era for peso-denominated bonds.

Let's go for a stroll.

Haven’t Downloaded Our Fintech 3.0 Report Yet?

A 58-page deep dive into how finance is being rebuilt on new rails, and why we’re at the beginning of a major technological platform shift that will reshape how financial products are built and scaled in Mexico. Download your copy here now.

🏚️ 15-Year View: Post Financial Crisis

Starting in 2010, the chart captures the aftermath of the global financial crisis.

The U.S. Federal Reserve had slashed rates to near zero to stimulate growth, a move that fundamentally altered the competitive dynamics of fixed income.

When rates are near zero, there's no yield advantage to holding T-bills. The only variable left is the exchange rate. If the dollar strengthens, holding USD outperforms. If it weakens, you lose.

From 2010 to 2015, the dollar was strong. USD/MXN moved from 13.04 to around 15 (when you see these numbers in the essay it’s the USD/MXN fx rate), or a ~15% depreciation in the peso. T-bills compounded at an average annual rate of 0.05%, or effectively zero. CETES, meanwhile, paid an average of 3.94% annually, or a 389 basis point premium.

In a world of zero U.S. rates, that spread made CETES compound quietly while T-bills barely moved. The dollar gained modestly on FX appreciation alone, but the rate differential meant CETES still outperformed on a total return basis.

🏛️ 10-Year View: The Trump Trade

Zooming into 2015–2025, the chart tells a more nuanced story. This window captures both the power and the limits of the trade.

T-bills averaged 0.74% annually from 2015 to 2020 while CETES averaged 5.83% (a 5.09% difference). This spread is derived for Mexico’s higher country risk, so it essentially isn't free money. Here we learn that the spread only matters if the exchange rate cooperates.

And from late 2014 through 2016, it didn't. T-bills and USD outperformed CETES despite near-zero U.S. rates because the peso collapsed under a perfect storm of global and domestic shocks:

Oil prices crashed from over $100 per barrel to below $30 by early 2016, hammering Mexico's revenues.

The Fed raised rates for the first time in December 2015 after seven years at zero, marking the beginning of monetary tightening and triggering capital rotation out of emerging markets.

Trump's campaign rhetoric on NAFTA and tariffs added Mexico-specific political risk starting in mid-2015.

USD/MXN moved from around 14.8 in late 2014 to over 20 MXN per USD by late 2016, depreciating roughly 35% in two years, and erasing even a 500 basis point yield advantage.

In late 2018, T-bills and the dollar continued trending up due to political uncertainty in Mexico. AMLO's (Mexican “left” wing president) election and ensuing policy shifts kept spooking the markets.

During this period, the dollar performed better because investors rushed to safety, and safety, as we know, meant U.S. assets.

When political risk materializes and FX punishes the local currency, even high rates can't save you.

🦠 5-Year View: COVID New World Order

The past 5 years, starting in 2020, is where things get extreme. The 🍌zone for CETES.

COVID hit in March 2020, and FX moved violently. USD/MXN spiked from 18.93 in January to 23.51 by March, a 24% depreciation in weeks, fear drove a “flight-to-safety” again.

But here two things happened that fundamentally altered the charts projected trajectory:

First, the U.S. debased its currency. The Fed printed trillions to support the economy during the pandemic, expanding its balance sheet and flooding the system with dollars.

That money printing eventually reversed the dollar's strength. By 2023, USD/MXN had fallen back to the mid-to-high 17s, a dramatic reversal from the COVID peak.

Second, the U.S. hiked interest rates aggressively. Fighting post-pandemic inflation (caused by money printing 👀), the Fed pushed rates from near zero to over 5%. That forced Mexico to hike as well. From 2020 to 2025, T-bills averaged 2.70% annually, and CETES averaged 7.89%.

This started the golden era of CETES.

Not only were rates higher than ever in the post-crisis period, but the peso strengthened after the COVID shock. USD/MXN ended 2025 at 17.97 (MXN per USD), down from the 23.51 peak and even below the pre-COVID baseline of 18.93.

Mexico's higher rates compounded, the peso recovered, and CETES delivered a cumulative return of 152% from 2010 to 2025, compared to 67% for T-bills and 38% for holding dollars.

This window also highlights country risk as a structural baseline. Mexico's interest rates are basically always higher than U.S. rates (not a bug, it's a feature). Investors demand compensation for exposure to a smaller, more volatile economy. The question lies in whether that premium is worth it, and over this time period, the answer has been yes.

There's also a third factor worth noting: nearshoring. As the U.S. and China decouple, the U.S. looks to reduce dependence on Chinese manufacturing and strengthen trade ties with regional allies, with Mexico becoming a prime beneficiary.

If the U.S. wants to invest in Mexico, dollars must be sold to buy pesos. You know what that means.

And the cherry on top. CETES win vs T-bills in a period of 15, 10, and 5 years.

CETEs performance in the past 15, 10 and 5 years

🎢 What’s Next?

On one side: continued U.S. government spending, Mexico's relatively manageable debt-to-GDP ratio of around 50% (vs over 120% in the U.S.), perceived political stability in Mexico (emphasis on perceived), and rising political instability in the U.S. all suggest this trend could persist.

If nearshoring continues and the peso remains stable or strong, CETES keep compounding.

On the other side: it could flip. Political risk could resurface in Mexico. The dollar could strengthen violently if risk-off sentiment continues. And U.S. rates could fall faster than Mexican rates, compressing the spread.

Coincidentally, I'm writing this as all assets trend down and there are rumors of, as Thiccy says in the Grand Exchange v8 a “dollar supremacy next week”.

So honestly, who the f*ck knows.

What we do know is that the market structure itself tells a story.

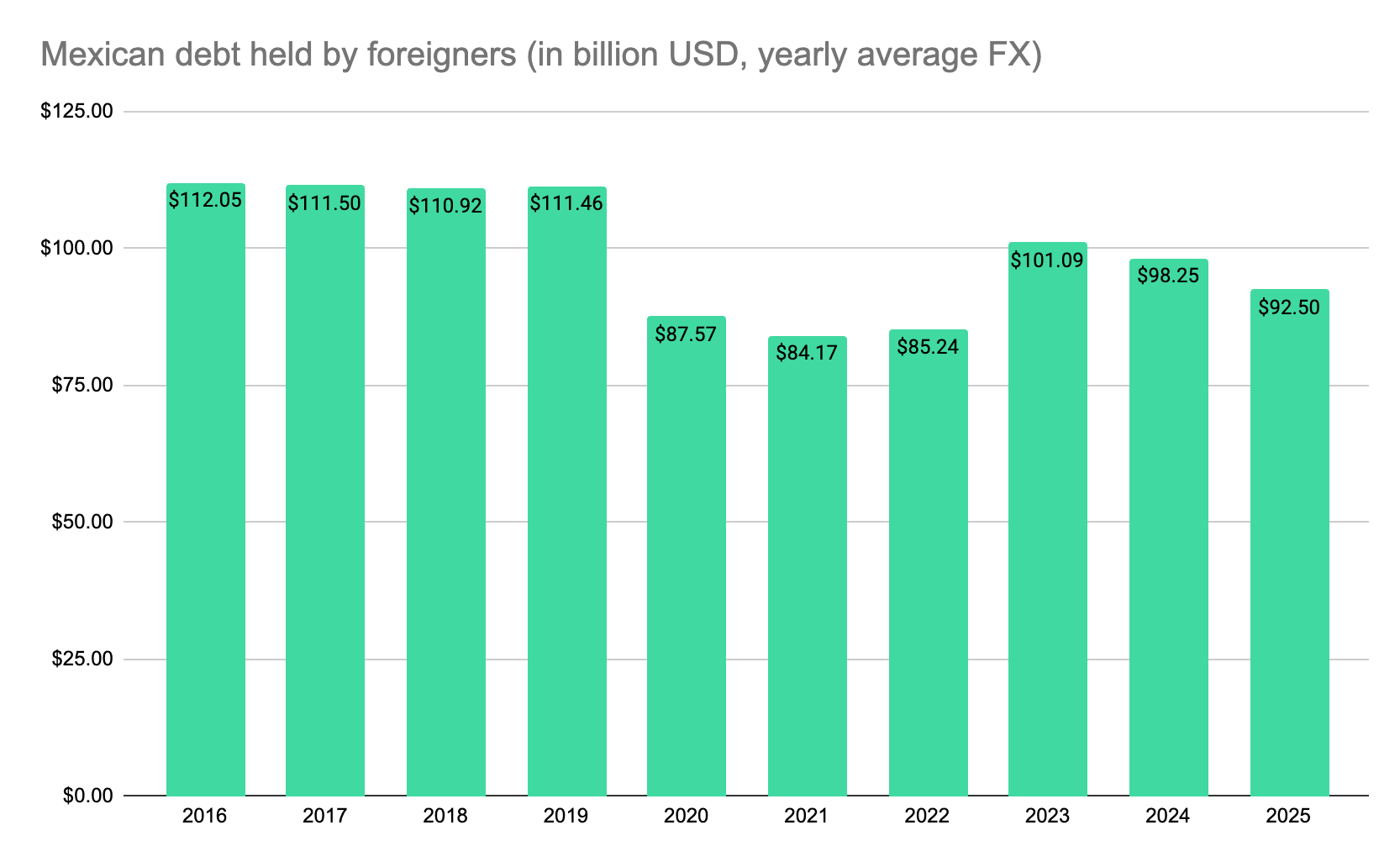

Foreign investors are abandoning Mexican government securities, cutting their stake from $112.05B from $92.5B in 9 years.

The 2.5x return over 15 years happened while 86% of the market remained locked in domestic institutional hands, with virtually no participation from hedge funds, sovereign wealth funds, or global allocators.

These numbers grabbed our attention and we'll explore the mechanics behind them in a follow-up essay, but for now, one thing is clear.

It seems like the market slept on this trade for at least a decade.

And for those looking to access the opportunity, we at Bando are building the infrastructure to simplify it.

We're creating an institutional-grade treasury management platform that modernizes access to Mexican sovereign debt, the way it should have been years ago, powered by Etherfuse's tokenized CETES Stablebonds.

We’re just giving allocators what they've needed for years: clean exposure to peso-denominated yield at 520 basis points over U.S. Treasuries, settled instantly onchain, without navigating Cetesdirecto's retail interface or establishing Mexican brokerage relationships.

The infrastructure that kept CETES captive for fifteen years is finally being rebuilt. More on this, soon…