- Frontera by Bando

- Posts

- ☃️ A Stablecoin Winter Wonderland

☃️ A Stablecoin Winter Wonderland

Your rare stablecoin-themed episode

Real problems. Real solutions. Real data. This is Frontera.

Your weekly dose of data-driven crypto insights from the edges of the world. Trusted by leaders at Bitso, Binance, the Solana Foundation, the Ethereum Foundation, and more.

This is where you start if you’re building, investing, or scaling in frontier markets.

Reading this by email? Click Read Online in the top right corner to view the full edition.

And don't miss this week's podcast where we break down last week's essay, on what we'd do if we ran the Nubank’s crypto team.

☃️ A Stablecoin Winter Wonderland

Not every week has a clear theme. In fact, I don’t think it’s ever happened before. But as I went through the headlines, I caught myself saying: “wait, everything is stablecoin-related.”

So if you liked Stablecoin Summer, you're going to love Stablecoin Winter.

This week, four major moves underlined the shift from fintech 2.0 to fintech 3.0. From slow, to fast. From old, to new. Legacy payment networks and banks are aggressively embedding dollar-backed tokens into their systems.

An acquisition, a new issuance, expanded settlement support, and a strategic partnership, each signal the same message. Well, maybe two:

For us, long gone are the days of being dismissed as a niche, unserious industry. For them, it's simple, adapt or die, survival of the fittest.

Back to the news…

1. A $2B Bet on Stablecoin Infra

First, Mastercard is making a $2B splash with its acquisition of Zerohash, a U.S. based startup that builds the backend infrastructure for stablecoins and tokenized assets.

Zerohash was valued at $1B in a $104M Series D funding round just last month, so you could say things are getting hot kind of quick.

The move expands Mastercard’s reach beyond payments signaling its intent to own the very rails that power the onchain economy.

2. Western Union Goes Onchain

Second, Western Union, the 174-year-old remittance giant, is launching its own stablecoin on Solana, marking a full-circle moment for one of the world’s oldest money movers.

The company plans to use blockchain rails to lower fees and speed up global transfers, directly competing with our friends at Félix Pago and El Dorado. Now it's a fair match.

3. Four Coins, Four Chains, Fourth Quarter

Third, Visa announced support for four stablecoins across four distinct blockchains, enabling conversions into over 25 fiat currencies and extending its crypto settlement infrastructure.

On the company’s Q4 earnings call, CEO Ryan McInerney revealed that consumer spending through Visa’s stablecoin services jumped 4x in Q4 compared to the same period last year. They clearly know where to double down, but honestly, they just had to look at their competitors.

4. A Partnership for the Ages

Fourth, Coinbase and Citi announced a collaboration to build institutional-grade stablecoin payment rails, leveraging Coinbase’s crypto infrastructure and Citi’s global network.

The winds of winter are blowing. There isn't a force in the world strong enough to stop what's next.

Brace yourself, (stablecoin) winter is coming.

🇧🇷 Brazil

In H1 2025, 71% of Brazil’s R$227B ($42B) in crypto volume came from dollar-pegged stablecoins, confirming USDT and USDC as the nation’s top tools for remittances, savings, and payments.

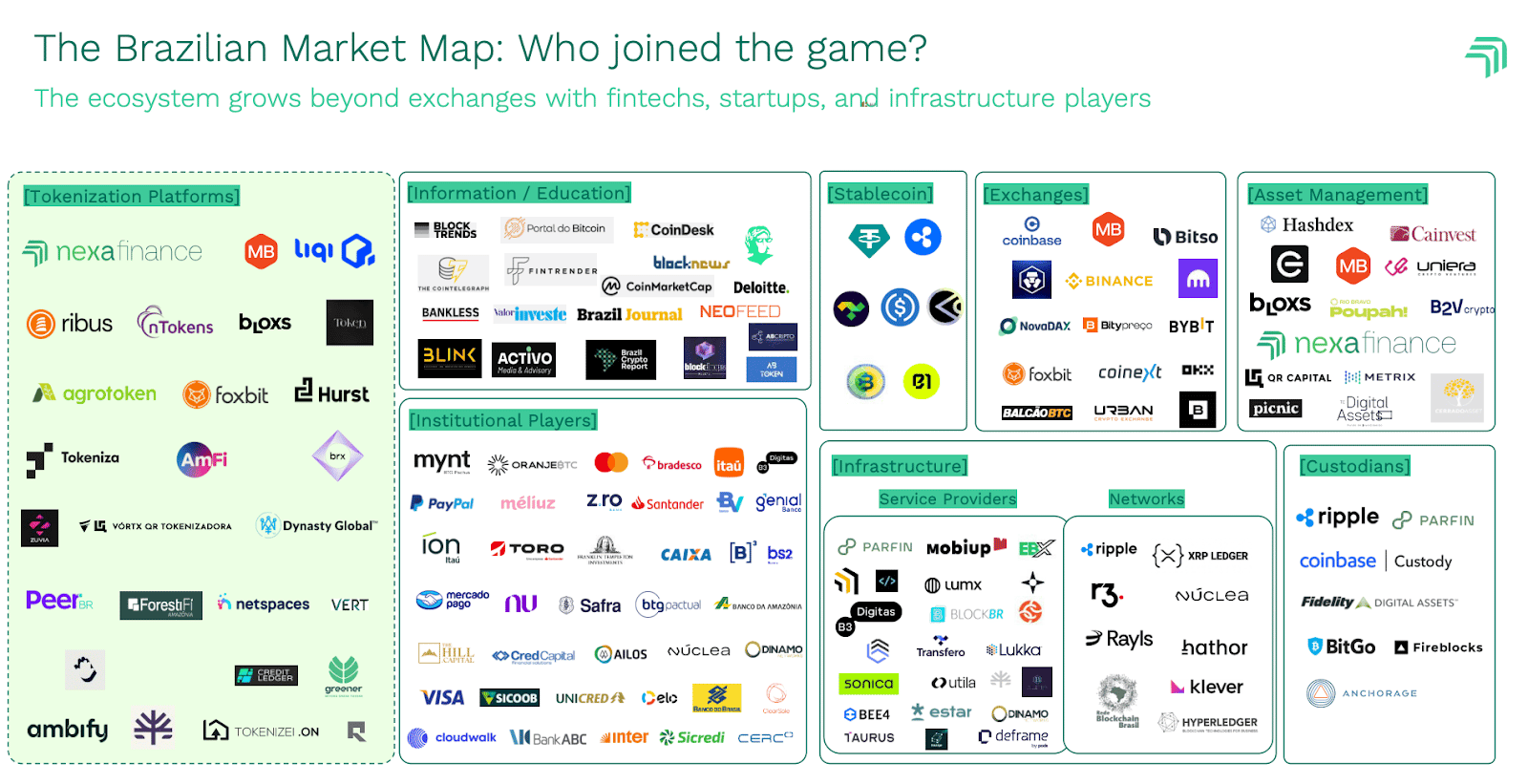

Nexa Finance published the Brazil Tokenization Report 2025, unveiling that the country has reached over $1B in tokenized assets as regulators fast-track crypto and stablecoin frameworks. Here's their ecosystem map as of now:

🇲🇽 Mexico

Our very own Ab spoke at Mexico Tech Week, the country's biggest startup and tech event, where he explained why stablecoins will power the next wave of fintech innovation (more on this soon). If you want a quick laugh, some memes, and free alpha check out his presentation here.

The British fintech giant Revolut received final authorization from CNBV and Banxico to begin operating as a fully licensed bank in Mexico.

🇨🇾 Cyprus

Looks like Mexico was not enough, Revolut also secured a MiCA license from the Cyprus Securities and Exchange Commission to provide crypto asset services in the EU. Rumor is that a stablecoin is coming soon.

🇨🇳 China

China’s Central Bank Governor said stablecoins amplify regulatory gaps, heighten global financial system fragility, and threaten monetary sovereignty in developing economies.

🇨🇦 Canada

Canada is accelerating regulatory work on stablecoins and is expected to include guidelines in its upcoming federal budget.

🇯🇵 Japan

Japan’s fintech firm JPYC has issued the country’s first legally-recognized yen-pegged stablecoin, backed 1:1 by yen deposits and government bonds.